Main menu

Donating Stocks, Securities, Mutual Funds - Here’s why you should do it!

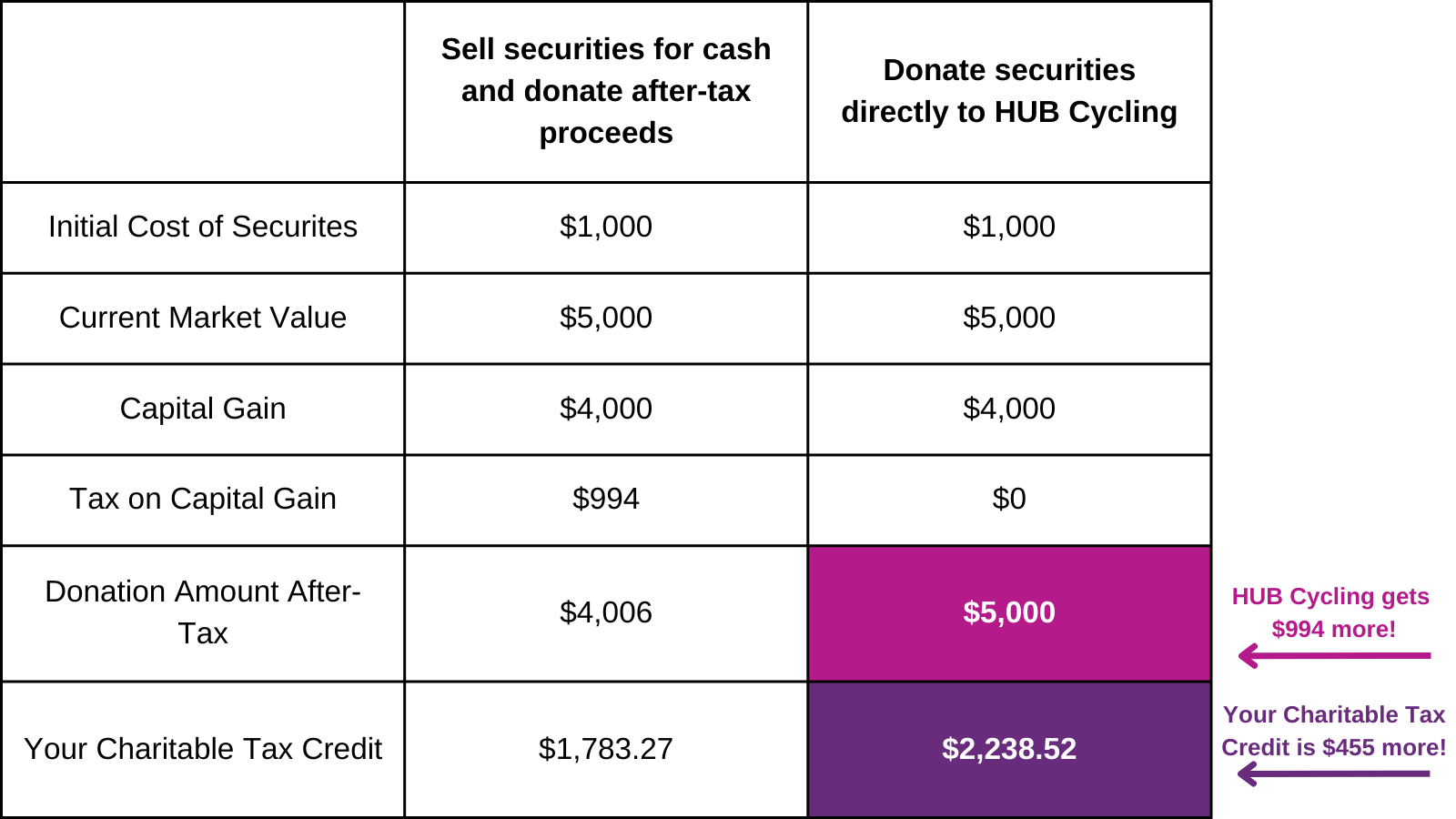

A donation of securities to HUB Cycling is exempt from capital gains tax and is worth a higher amount for your donation tax credit. Your gift will result in a non-refundable tax credit reducing your income taxes.

You can use it in the year of your gift or carry it forward for up to five additional years.

There is no limit to the amount you can donate in a year.

Instead of paying taxes on your securities when you cash them out, you can gain tax incentives by donating your stocks directly to HUB Cycling. This means that the amount you donate by securities is more than if you sell and donate the proceeds.

HUB Cycling is a qualified donee as a registered Canadian charity. Consult your advisor today to make a meaningful contribution to HUB Cycling to get even more people cycling more often.

Make sure your broker does not sell before transferring.

Your charitable tax receipt is based on the closing price on the day the security was received.